Tracking trade rumors is a pretty useless exercise if you are a fan with any degree of self-control (which I admit, I am not always). Everyone gets excited about the random rumor involving their favorite team, and I suppose there’s some fun to constantly refreshing Twitter to find out if your team traded for this player or that player.

For Mets fans, the red-coiled burner on the proverbial Hot Stove this offseason involved a potential trade for Starling Marte, who was ultimately traded to the Diamondbacks in exchange for two prospects. While this is a good example of a trade rumor that remained a whisper, it gives us a good opportunity to look at what a hypothetical trade could have looked like for the Mets, and in doing so, I think we will learn about the current team.

What can we learn? A few things: First, it allows us to evaluate the depth of the Mets farm system; second, it helps us in trying to identify the relative value of Brandon Nimmo; third, it makes us consider the luxury tax and the amount of money available for future spending, which, fourth, raises the question of Yoenis Cespedes and where the Mets potentially see him fitting on the roster given his injury status.

Selling the Farm

There are two ways of looking at this hypothetical trade from a potential return standpoint. We can believe the rumors that the Mets needed to offer Brandon Nimmo plus another top prospect to make the deal work, or we can look at the return that Arizona forfeited and assume the Mets would have needed to offer something similar to slightly better — such as two prospects of similar value whom Pittsburgh for whatever reason liked more, or perhaps, an offer of Brandon Nimmo, alone.

Before we get into Nimmo, there were a few problems with the Mets offering a prospect-only return for Marte. First, there are roster practicalities. Adding Marte to an outfield that already includes Brandon Nimmo and Jake Marisnick (along with several other outfielders) doesn’t make sense. Second, the Mets aren’t in a position to dip into their prospect ranks for a modest improvement.

It is no secret that after trading Jarred Kelenic and Justin Dunn in the Edwin Diaz/Robinson Cano trade and Simeon Woods Richardson and Anthony Kay in the deal for Marcus Stroman, the line of promising prospects leading to Citi Field is not very long. In acquiring Marte, the Diamondbacks traded two prospects with a future value rating from FanGraphs of 50 and 45+, leaving them, still, with nine prospects in their system with future values falling between 45+ and 55. The Mets only have six such prospects, meaning trading two of them in a deal for Marte would have left their system completely thin along the top.

In my opinion, the only way a trade for Marte would have made sense for the Mets is if they had exchanged major league talent for major league talent. By trading Nimmo straight-up for Marte, it would have opened up a position for Marte to play everyday (sorry Mr. Marisnick) and offset some of Marte’s higher salary, while, theoretically, improving their roster in the near-term. So should fans be wishing the Mets traded Nimmo for Marte? Not so fast.

Nimmo’s Value

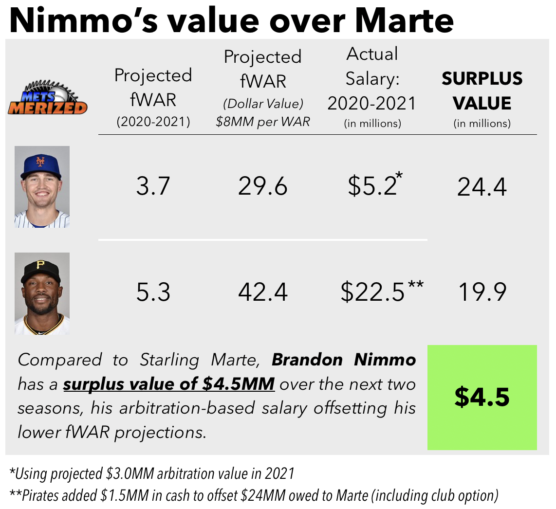

I think it is fair to say that Starling Marte will likely have a more productive season than Brandon Nimmo next season, and perhaps even the following season. If we look at the projections provided by Steamer on FanGraphs, we see that Marte is projected to produce 2.9 wins above replacement (fWAR) next season compared to only 1.7 fWAR for Nimmo. Using the aging curve to carry those predictions one season farther, Marte is projected to produce 5.3 fWAR (since he will be 32 years old, we subtract 0.5 from his previous season’s fWAR), while Nimmo would be projected to add 3.7 fWAR (adding 0.3 to his previous season’s fWAR as a 27 year old). If money didn’t exist and contract length didn’t matter, trades would be easy, and we could reasonably assume, even without all of the fancy projection math, that trading Nimmo for Marte would make the Mets better over the next two seasons.

But money and contract length do matter, especially for a team that is very much still owned by the Wilpons. The question then becomes whether the projected 1.6 added in fWAR over the next two seasons from Marte compared to Nimmo is worth the nearly $18 million more he could be owed in salary. The table below summarizes the answer to this question and shows that given Nimmo’s arbitration-based salary, the Mets will likely receive a surplus value of nearly $5 million by keeping Nimmo instead of trading him for Marte.

For salary calculations, I offset Marte’s salary by the same $1.5 million Pittsburgh gave to Arizona. I also projected Nimmo’s 2021 arbitration number to rise from $2.2 million to $3.0 million in 2021. Since Starling Marte’s contract has a club option that expires in 2021, this analysis only considers the next two seasons, which is sort of a catch. At that time, when Marte is a 33-year-old free agent, Brandon Nimmo will only be 28-years-old and would still be under team control for one more season.

Now, we could make this analysis even more complicated by considering the potential trade value of Marte in the future. For example, Marte could play the 2020 season in orange and blue, the Mets could exercise his 2021 option, and then trade him as an expiring contract to a contending team during that season. By doing so, it would be possible to recover some value, perhaps in the form of prospects, in the future. This is why breaking down trades, hypothetical or not, is complicated. There are a lot of moving pieces beyond the ones actually moving in the original trade.

Luxury Tax Considerations

I mentioned how money still matters for a team “very much still owned by the Wilpons,” but that is not to suggest that the luxury tax threshold is something to ignore even under different ownership. As much as we dream of Steve Cohen taking over the team and spending at such a ridiculous rate it makes their crosstown rivals blush, the luxury tax matters. Only three teams surpassed the minimum threshold last season.

As things currently stand, the Mets luxury tax payroll hovers around $197 million, which is $11 million shy of the first tax level of $208 million. Trading Nimmo for Marte would have increased the Mets payroll $7.8 million, leaving them only ~$3 million in breathing room before the first tax penalty. And this is where Yoenis Cespedes enters the conversation. His salary was restructured to $6 million in 2020, but it would increase to $11 million if he starts the season on the active list or injured reserve for an injury not related to his infamous ranch accident. If the Mets somehow believe that Cespedes will start the season on the active list, they might be trying to keep more than $3 million in breathing room to absorb his added $5 million in salary without paying a tax on it.

If we want to be practical and assume that Cespedes doesn’t see the active roster on Opening Day, or any day soon for that matter, the Mets have left themselves with a decent amount of space to make another move this season to improve their team. Remember, the stronger Brandon Nimmo performs on the field, the more surplus value he creates relative to what the Mets would have had to pay to someone like Starling Marte as a potential upgrade. But the Mets only realize this surplus value if they use the cost savings from Nimmo’s production to acquire additional value somewhere else.

I think the Mets made the prudent move in holding on to their assets (and money) instead of trading for Starling Marte. How much surplus value they actually gained from this decision will be determined by the players in question and the future investments made by the Mets front office over the next few seasons.