Michael Breit was a guest on YES Network’s The State of Sports where they discussed the state of the Mets finances, the refinancing, revenue and cash flow.

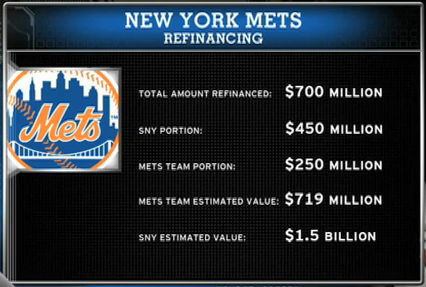

The Mets took advantage of better interest rates which was the main factor in refinancing $700 million dollars in debt.

With the refinance the Mets cashed out a significant sum for things like capital improvements, paying down other debts, and future spending for the team that would allow for type of contracts they just gave David Wright.

Breit say this was the right move for the Mets owners and they did it at a time where they took advantage of optimal rates that allowed them to cut monthly and quarterly debt payments and free up a large sum of cash for other uses and concerns.

The refinancing also positioned the Mets for combating future cash flow problems due to sagging attendance that will certainly lead to decreased revenue streams in 2013.

Breit estimates that the Mets need to reach a 2.3 million in attendance just to break even, and so now with this new influx of cash, the risk of a shortfall will not hurt them in the pocket moving forward as they look to rebuild the team and the brand.

Another reason for the timing of the refinance is because the value of the SNY Network is peaking and at an all-time high. Mets owners hold a 65% share of SNY and it’s speculated that it could now be nearing $2 billion dollars in value. This enabled the Mets to leverage that value to address other problems and was the strategically correct thing to do.

The one thing you can call a negative where SNY is concerned, is that nobody could have predicted that major broadcast providers like Fox would be offering massive regional sports contracts like the ones we recently saw with the Dodgers and Angels.

Sports franchises owning their own networks became trendy and seemed like the way to go 5-10 years ago. But now, teams in major markets rake in about double the broadcast rights revenue that SNY generates for the Mets. In my opinion it puts the Mets at a competitive disadvantage both now and in the future. The Yankees don’t (and won’t) have that problem as they are the gold standard in the industry.

There were a few folks out there last month, who reported that the Mets would pay dearly for leveraging SNY the way that they have. But Briet says there’s no big concern about that. If the Mets were leveraging SNY at anything close to an excessive level, their partners, Time Warner and Comcast, would have never allowed that to happen — and that both media giants have a big say in how much debt is leveraged against SNY. The Mets did well to partner with both of them when they did.

Anyway, I thought some of you would be interested in my thoughts on this and also in what Michael Briet had to say on the matter. Too bad you don’t get such perspective from SNY themselves and wouldn’t it be great if they had their own “Business of Sports” type programming instead of… I don’t know, Beer Money? Of course that would raise a totally different set of problems for them, like having to find a host who knew their ass from their elbow. But, hey… they keep increasing in value, so what the heck do I know.

You can watch the entire interview online at Yes Network.com.