The first question that needs to be answered is, “if there are changes in how Major League Baseball games are available on television, will those changes affect the broadcast of New York Mets games?” The answer is no, but significant changes in television coverage may be coming very soon for almost two-thirds of MLB teams.

The story, as documented in an article by Daniel Kaplan in The Athletic, goes like this. Diamond Sports, which owns the Bally’s Sports Networks, a system that includes 14 Regional Sports Networks (RSNs) that cover MLB games, is expected to file for bankruptcy this week. Further, Warner Brothers Discovery owns three RSNs that cover MLB teams (Astros, Rockies, and Pirates). Those RSN contracts are set to expire on March 31.

On April 1, fans of 17 teams may not have access to their teams’ games. While that is a possibility, it’s unlikely that all 17 teams will vanish from the airwaves. In the case of Warner Brothers Discovery, according to Kaplan, they have made plans for crews and trucks to be available to cover the three teams referenced above. Also, sports are a very minor component of Warner Brothers’ business model, which generates the vast majority of revenue from television shows and movies. They can take a loss on sports programming.

The case of Diamond Sports is more interesting. It could open new doors for baseball fans to view games. If the bankruptcy goes forward and some or all of the 14 teams’ games are no longer covered by Diamond Sports RSNs (a choice they would make in the filing, to divest of certain non-profitable entities as would any business filing for bankruptcy protection), some long-awaited changes may occur.

Currently, the RSNs have a hold on the games they broadcast in their local markets. This is why streaming is not available in the local market via a service such as MLB.tv, except if the RSN streams the game itself (like SNY does). The streaming blackouts have frustrated fans for years, who may be in an area where the RSN is not carried, but is still considered the team’s local market so streaming is not permitted. If the RSNs exit the picture, then teams may be able to offer several options, including some games on over-the-air television, and the all-important streaming option.

The other side of teams making their games available via other paid avenues (e.g. streaming) is that the cost of the service will likely be significantly more than people are paying for RSNs as part of their television packages. The article provides this example:

“Let’s say you have $4 a month” that a cable consumer pays for an RSN, explained sports consultant Marc Ganis, every subscriber pays it. “If only 20 percent buy (a new standalone option), just to get the same amount of subscription, you’ve got to pay a multiple of five for those who want it. That’s just mathematics.”

“If you take a step back, this is the first time that this many baseball games, this many soccer games, or this many college sporting events will have been available for consumers to find somewhere, whether it’s streaming or on a linear basis,” said William Mao, senior vice president of media rights consulting at Octagon. “And so if that does necessitate an increase in overall wallet, that share of wallet or the size of that wallet will be different for different consumers.”

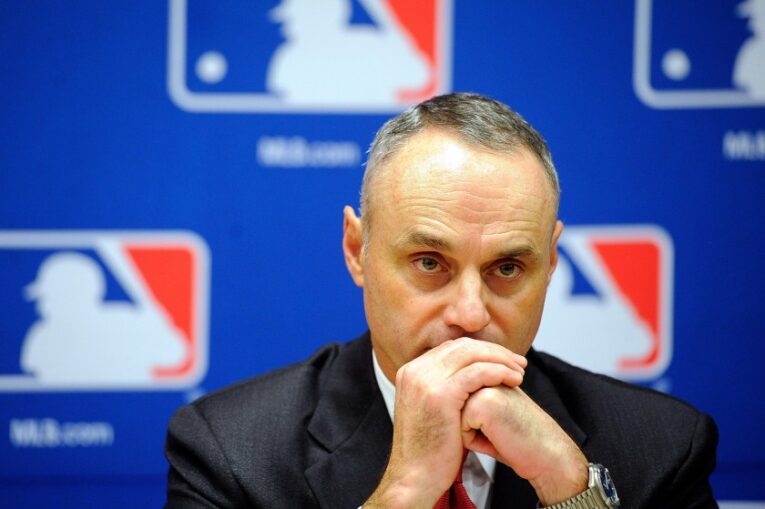

Baseball is changing on the field. The rule changes for 2023 are significant, and there may be more coming. Now, the way fans consume baseball content may be radically different. Commissioner Rob Manfred does not seem concerned about the potential end of MLB’s relationship with several RSNs. He seems to think it’s time for the viewership model to change. On this point, fans who have tried unsuccessfully to stream games may agree with the commissioner.

More options to watch baseball games will not be a bad thing. Increased costs may not be a fan favorite, but for fans in the midwest (for example), who are hours away from teams but cannot stream games nor get the RSN, local contests would become available in the post-RSN world. Making the product available to more consumers is just good business.

Let’s see what happens by April 1. We may be on the doorstep of an important evolution in how MLB content is provided to consumers.