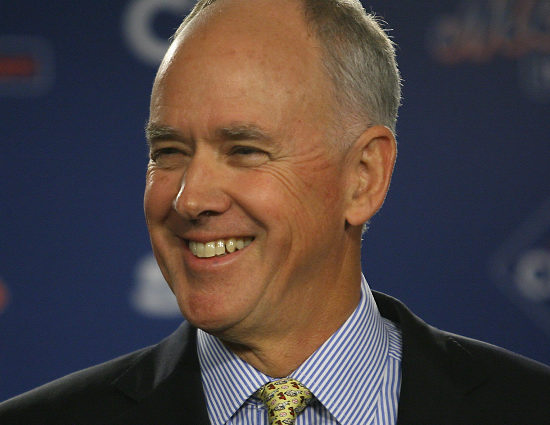

Most of us hope that somewhere in Sandy Alderson’s intellect there resides, like the temple of Apollo, a splendid orange and blue architecture detailing the resurrection of our franchise. Many of us believe this vision has something to do with numbers and graphs and newfangled statistics like Z-swing% and wOBA, but what if it isn’t that at all? What if it’s something entirely different? For all his connections to ideology, Sandy Alderson appears above all to be a pragmatist, which is odd in a business where an entire season can hinge on a bad bounce or an awkward twist of a knee. Baseball is a game of hard chances and calculated risks, a patchwork guesswork of cheated inches and hanging breaking-balls where even your best-laid plans go astray three out of four times (if you’re good). It is not a game for the timid, it is a game where taking chances is rewarded and success is often the result of wild and unpredictable swings in fortune.

Our current GM does not seem to fit the wheeling and dealing persona, he seems more like an economics professor than a gambler. He makes consensus driven decisions, doesn’t spend lavishly on flashy talent, tightly sticks to practical limits, and seems to abide more in the future than the present. For this he appears to be roundly detested by a healthy contingent of fans who still have no real sense of what his “plan” might be.

By trade Sandy Alderson is a lawyer. He’s also an MLB insider and has been for many years. He knows the business end of the game probably better than just about anyone – even lecturing at the University of California Berkley, Haas School of Business. If Sandy settles on a business model I think it fair to say it will probably be a good one, one that will ensure success by securing value and controlling assets. Sandy’s approach to finding and securing talent, may not necessarily reside in the latent value of the assets (the players) at all, it may revolve around the efficiency of the mechanism which funds the purchase of those assets. Talent doesn’t do you any good if you don’t have the ability to pay for it. Sandy’s innovations may have less to do with how his business crunches numbers (everyone is doing that these days), and more to do with the efficiency of the business model itself.

In assessing how the Mets may have changed their approach to the business of Baseball, it’s important to consider the new 2011 Collective Bargaining Agreement which is surprising both in its scope and length (5 years). The CBA addressed the draft and Free Agent compensation with some eye-opening changes. Type-A and Type-B Free Agents are a thing of the past. The new system eliminates compensation for players who elect free agency unless they tender a “qualifying offer.” A qualifying offer is a one-year deal for the average of the top 125 salaries the previous season. This year it’s expected to be about $12.5 million. This has several repercussions, firstly, mid-season trades become less valuable to the receiving team because (like the Carlos Beltran trade) the receiving team does not get any draft pick compensation if that player elects free agency at the conclusion of his contract. Previously losing a type-A free agent would have netted a team 2 draft picks. Teams who’ve traditionally been able to afford high priced players are not receiving the compensation they were under the previous agreement. This is probably why we’ll be seeing fewer trades like the Ryan Dempster trade (or when they are made the return for these players will be diminished), and more trades like the R.A. Dickey deal where the receiving team signs the player to an extension. This is not to say teams who are desperate won’t make in-season trades, there just won’t be as many.

In assessing how the Mets may have changed their approach to the business of Baseball, it’s important to consider the new 2011 Collective Bargaining Agreement which is surprising both in its scope and length (5 years). The CBA addressed the draft and Free Agent compensation with some eye-opening changes. Type-A and Type-B Free Agents are a thing of the past. The new system eliminates compensation for players who elect free agency unless they tender a “qualifying offer.” A qualifying offer is a one-year deal for the average of the top 125 salaries the previous season. This year it’s expected to be about $12.5 million. This has several repercussions, firstly, mid-season trades become less valuable to the receiving team because (like the Carlos Beltran trade) the receiving team does not get any draft pick compensation if that player elects free agency at the conclusion of his contract. Previously losing a type-A free agent would have netted a team 2 draft picks. Teams who’ve traditionally been able to afford high priced players are not receiving the compensation they were under the previous agreement. This is probably why we’ll be seeing fewer trades like the Ryan Dempster trade (or when they are made the return for these players will be diminished), and more trades like the R.A. Dickey deal where the receiving team signs the player to an extension. This is not to say teams who are desperate won’t make in-season trades, there just won’t be as many.

MLB Draft rules have also been altered significantly. Depending on a given team’s place in the draft order and number of selections, the allotment per team ranges from $4.5 million to $11.5 million over the entire draft. Teams will no longer be able to spend as freely on the draft as the the Nats did in August of 2011 when they grabbed Anthony Rendon, Alex Meyer, Brian Goodwin and Matt Purke. In anticipation of the new slot restrictions, the Nationals spent 16.5 million on their first 5 picks in 2011. Under the current agreement, if teams spend more, the penalties are truly prohibitive (75% tax for being 5% over and a loss of a draft pick if the team goes 10% or more over budget). As a result, spending overall on the draft dropped from 238 million in 2011 to 208 million in 2012 with 18 million of that decrease reflected in just the first 7 picks as reported by Jim Callis of Baseball America.

The new CBA draft rules are basically a price fix. The next Bryce Harper or Mike Trout will be signed at a fixed rate, if they sign at all. For young athletes trying to decide between sports, this may prompt them to steer clear of a baseball career. Scott Boras believes it will weaken Baseball’s talent pool. Six picks immediately following the first round will also be given out via lottery to teams with the 10 lowest revenues — another “competitive balance” salvo. Teams are also no longer allowed to hand out major league contracts to draftees — which was yet another incentive to players like Strasburg and Harper. Whether it works remains to be seen. The intent to create greater parity is certainly there, but smaller markets were already taking advantage of the loose slot recommendations of the previous agreement. There are also no restrictions after the first ten rounds, are we going to have a situation where a talent bubble is pushed to the 11th round after the “penalty phase” ends? Small market teams will probably spend what money they have during the draft, but larger markets may be able to spend a lot more on players who may fall to these later rounds without fear of reprisal.

Paul DePotesta (Mets Director of Scouting and Player Development) has, unlike his boss, been more inclined to roll the dice on young athletic prospects during the draft itself. The Mets have been commended for balancing both high ceiling (albeit risky) early picks and more conservative safe bets. They’ve focused heavily on hard-throwing right-handers with durability profiles and the results so far have been tantalizing. We’ve seen a marked decline in pitching injuries this past season and a startling improvement in ERA across the minor league system. So, at least objectively, the Met farm is improving, but enabling an effective “feeder system” is only one component of the business model.

Alderson seems to have left the baseball end of the organization to DePotesta and Ricciardi while he’s focused on streamlining the business and the administrative domains. We’ve bemoaned the fact that even in 2011 when we could have spent over slot on the draft, we did so only marginally (although that may have simply been because we weren’t presented with the opportunity to spend big). We may, however, erroneously condescend to presumed expedients which in actuality are meant to conform more effectively to a new structure. The more seamlessly we mesh with MLB’s current parameters, the more we can take advantage of the system’s built-in yields (i.e., hidden value). We didn’t spend over slot even when we knew we could, just as we aren’t spending on free agents now even though we can. Unlike the Nats, there will be no “adjustment period” in adapting to the stricter slot regulations. For the Mets it will be business as usual.

Alderson seems to have left the baseball end of the organization to DePotesta and Ricciardi while he’s focused on streamlining the business and the administrative domains. We’ve bemoaned the fact that even in 2011 when we could have spent over slot on the draft, we did so only marginally (although that may have simply been because we weren’t presented with the opportunity to spend big). We may, however, erroneously condescend to presumed expedients which in actuality are meant to conform more effectively to a new structure. The more seamlessly we mesh with MLB’s current parameters, the more we can take advantage of the system’s built-in yields (i.e., hidden value). We didn’t spend over slot even when we knew we could, just as we aren’t spending on free agents now even though we can. Unlike the Nats, there will be no “adjustment period” in adapting to the stricter slot regulations. For the Mets it will be business as usual.

Alderson knows that with this new CBA it will be harder to secure talent by simply paying more both in the draft and through international signings, which may be fine by him as the Mets appear not to have more to pay. The new CBA rules will also gradually eliminate all revenue sharing dollars for the Mets by 2016 because we reside in one of the top 15 Baseball markets. This makes it even more imperative that Sandy get his financial house in order, and to this end it can’t hurt that the Mets appear to be on the same page with MLB’s more stringent paradigm. The big mid-season “fill a need” trade the Yankees are so famous for will no longer allow them to restock their farm system while they also won’t see nearly the same level of talent drop in the draft order due to cash concerns.

By adapting fluidly with these changes the Mets may maneuver their baseball/business operation into a position of optimal efficiency. Opportunities tend to present themselves to those who are in the right place at the right time, and it appears Alderson is trying to move the Mets into that advantageous efficiency niche. For Sandy, spending money now not only goes against the sustainability model, it makes no sense competitively as we’re a good 40 – 45 million (in free agents who probably wouldn’t sign with us anyway) from a shot at the wildcard.

If Sandy were to sign 25 million in contracts tomorrow, contracts that would likely run into 2016 and 2017, we’d be spending money in advance of 2016 without knowing what our needs will be in 2016. So the business model, if I’m to interpret its workings by its activity (or lack thereof), reflects a “practical gambling” sensibility. Better to bet on a sure thing than a long shot. It makes no sense to bet on the 2013 Mets, there are too many holes and too many questions. We’re better off waiting for a critical mass of talent to roll onto the major league stage before investing. Spending now on an extreme long-shot would restrict the team later on when we’d be far more likely to benefit from a cash infusion. This money will also be available at a time when we’ll already be losing considerable revenue sharing dollars.

We’ll probably be around 95 – 100 million for the foreseeable future, and that may be just enough if even half of our pitching prospects pan out. One major contract (David Wright) every couple of years or so? Serviceable complementary players and a steady infusion of talent from a revitalized farm system? Spending only when you are legitimately putting the team “over the top” and not for entertainment value? A tendency to avoid “qualified offer” Free Agents? Developing and signing your own players to extensions before they reach free agency? Adapting fluidly to MLB’s draft recommendations? Annual flexibility of at least 20 to 30 million (which we are in effect already starting to see)? This is the business model. I’ll take that kind of sustainability any time over the occasional go for broke shopping sprees of previous off-seasons, as exciting as they were at the time.